The freelancer's guide to cash flow management

Crappy at managing your cash flow? Mark James of Crunch Accounting provides some tips and techniques that’ll help you get your cash flow management back on the right track.

An ex-freelance writer, I appreciate how infuriating the financial side of freelancing can be. At times your flush, at others you’re crushed, forced to turn over settees and flail around for cash. A lack of marketing, a loss of a client, mere bone idleness on your part - there’s a number of things that can fuel a famine in your finances, but, more often than not, poor cash flow management will shoulder most of the blame.

In-house at an accountancy firm for just over a year now, I’ve seen how integral good cash flow management is to a freelancer’s success. So, drawing upon my own experiences and some of the office expertise, here’s a brief course in cash flow management for any of you freelancers being crippled by a lack of cash...

- Read all our career-related posts here

01. Ensure your clients are serious

Unfortunately, there’s an abundance of unscrupulous clients out there, more than willing to take your work but less than willing to pay up for it. These charlatans can wreak havoc on your cash flow, so try to weed them out from the start.

Where the project’s especially big and you’re investing a lot of time, ask for a deposit before you start work - perhaps somewhere around the 25 per cent mark. If they've committed to this, then chances are that they’re serious and you can trust them to pay up later down the line. Better still, consider asking for payment upfront, perhaps offering a discount to those willing to cough up from day dot.

Never feel like you need to stick to the conventional 30 day payment terms - there’s nothing in place to say you have to stick to this. You can shift payment terms to meet your cash flow needs.

02. Learn your legalese

Going into a job without a contract in place you’ll be lacking a legal leg to stand on, making it trickier to track down that cash should things go awry. So contract up, before you take on a job. Our sister site, Freelance Advisor, has a list of everything you should include in a contract along with some samples here.

Elsewhere, be aware of your rights should you come across a client that’s refusing to pay up. In the UK, for instance, you can hammer them with late payment penalties. Back in March the Late Payments Directive was introduced, giving freelancers extra teeth to deal with those unscrupulous clients, so if worse comes to worst you can frighten them into coughing up.

Daily design news, reviews, how-tos and more, as picked by the editors.

Spending a little time to get to grips with the legalities, you should spare yourself from becoming another cash flow casualty.

03. Invoice immediately and chase vigorously

Getting invoices out there immediately will limit the lead-time in getting paid, so get them out there as soon your payment terms allow.

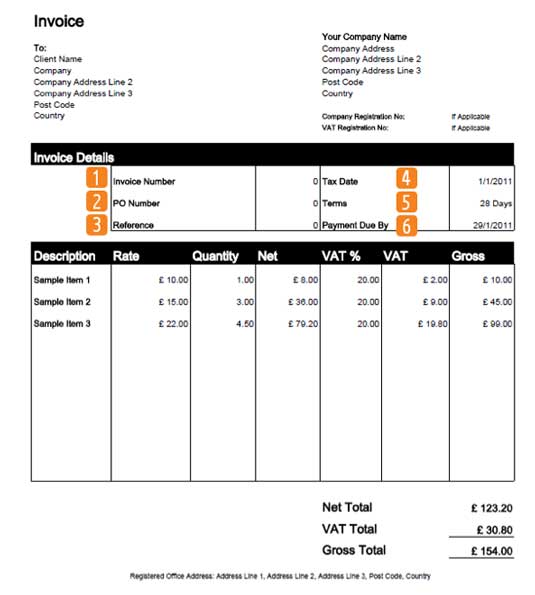

Always ensure that they’re sufficiently clear and detailed though, and that they reflect the terms of your contract, so that your client doesn’t have any reason to query the invoice or worse still, delay or withhold payment. You can get your mitts on some handy templates here if you’re not sure what to include. Elsewhere, consider getting some invoicing software.

Now, when I say chase them vigorously, I don’t mean nuisance calling your clients day and night. I mean keep a keen eye on issue dates and the like and where payment is due, set about chasing them up. Issue reminders - make a phone call, send an email, send the boys round (joking).

04. Build a buffer

Remarkably, this is something that many freelancers fail to do, despite the fact that paydays are a lot more erratic and troublesome to predict when you’re self-employed.

The PCG advises freelancers to build a buffer of cash that’ll last them six months, should things get particularly tough. That may seem a tad extreme, but drawing upon personal experience I’d say that’s a wise thing to do. After my first big paycheque I splashed out on a holiday to Ibiza and frittered away most of that money on Coronas and clubbing.

A week or so after returning the credit crunch hit and work became ten times tougher to come by. You never know what’s around the corner - economically or personally - so be frugal with your funds and put a little cash aside.

Words: Mark James

Mark James is an in-house Writer at Crunch Accounting, a Brighton based online accountancy firm and Freelance Advisor, a resource site for freelancers in the UK and beyond.

Liked this? Read these!

- Free Photoshop actions to create stunning effects

- Create a perfect mood board with these pro tips

- The best Photoshop plugins

- The ultimate guide to designing the best logos

Have you found a good solution to freelance cashflow problems? Share it with the community in the comments below!

The Creative Bloq team is made up of a group of art and design enthusiasts, and has changed and evolved since Creative Bloq began back in 2012. The current website team consists of eight full-time members of staff: Editor Georgia Coggan, Deputy Editor Rosie Hilder, Ecommerce Editor Beren Neale, Senior News Editor Daniel Piper, Editor, Digital Art and 3D Ian Dean, Tech Reviews Editor Erlingur Einarsson, Ecommerce Writer Beth Nicholls and Staff Writer Natalie Fear, as well as a roster of freelancers from around the world. The ImagineFX magazine team also pitch in, ensuring that content from leading digital art publication ImagineFX is represented on Creative Bloq.