How to calculate your shop rate

In order for your design company to turn a profit, you need to work out your shop rate. We explain how.

Brad Weaver will be speaking about pricing your work at Generate London, 21-23 September. In his talk he'll discuss rates, prices, and profit using actual projects, and you'll leave with real numbers and tools to use in your business to get control of your pricing strategy the very same day. Don't miss out; book your ticket now!

Profit isn't easy to talk about. Often it's an afterthought. But if you're a creative director in business, you're out to make a profit. To be blunt, if you're not making a profit, you're not running a business; you just have a job.

Profit is simply the difference between the amount earned and the amount spent when producing something. So how do you make sure you're making a profit consistently, and not just when a project goes really well?

You need to know exactly what you need to make in your business to thrive, not just survive, and to treat profit as a necessary part of your budget, not additional revenue from individual projects. The first step is to work out your shop rate.

Shop rates

You need a basis for all your pricing calculations. Most people use an hourly billing rate, which is unwise. Those rates aren't specific to you; they're based on guidebooks, blog posts, and what your friends charge.

Sustainably profitable companies use hard maths to determine how much to charge. They know something our industry is still learning: your gut is not a calculator.

Your business has a limited amount of time to sell each month, regardless of how you bill. There are a few ways to overcome this limitation, but each is flawed.

Get the Creative Bloq Newsletter

Daily design news, reviews, how-tos and more, as picked by the editors.

- Raise your rates: There's a limit to how much you can charge per hour, and you could price yourself out of the market

- Hire cheaper: Hiring those who make less than your hourly billing rate can cause your overhead to rise quickly, and employees may not produce the quality of work your clients expect

- Build in profit on a per-project basis: It's unreliable to calculate costs and profits on a per-project basis; you can only control so much

So what's the solution? You need to find something called your shop rate:

(Expenses + profit) ÷ hours = shop rate

Find out what it costs to run your business, add in profit up-front, and then divide it by how much time you have. This tells you exactly how much each unit of time you have to sell is worth, which you can then use to calculate your project prices. Knowing your shop rate puts you in control of your pricing strategy.

Expenses

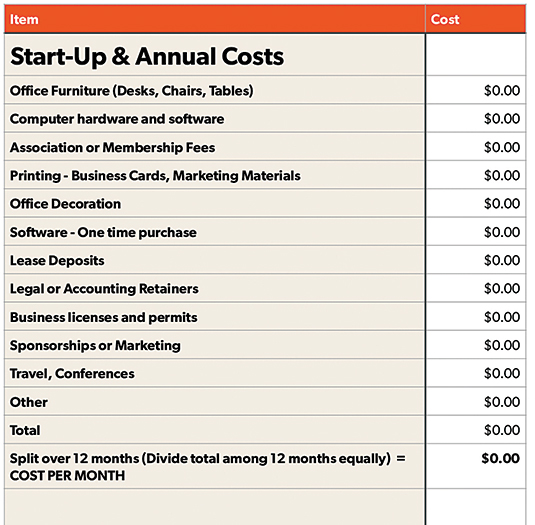

Expenses include your recurring monthly spending, annual spending, your salary, the salary of any staff or contractors, and taxes. Broken down into a formula, it looks like this:

(Recurring expenses + 1/12 of annual expenses + your salary + staff salaries + contractor fees) × 1.25 = expenses

Recurring expenses include rent, software, utilities, supplies and routine purchases. If you don't know your monthly costs, create a budget and stick to it. This isn't easy, so be honest and give yourself extra room.

Annual expenses include anything you have to pay for annually or quarterly: large purchases such as computers, furniture and conferences. Divide the cost of each annual expense by 12, to account for 1/12 of that expense each month. This will help you eliminate surprises throughout the year.

Then pay yourself a salary that meets your lifestyle needs. Find a good number that matches what you'd make if you worked for someone else. Also include the salaries of anyone who works for you.

Contractors should be priced at a fixed amount for each project unless they work for you all the time. If that's an irregular expense, again you need to set a budget and stick to it.

Finally, save for taxes. Tax liabilities vary by country of business. Know what they are and make them a line-item in your budget – don't try to ignore them until the bill comes. We use 25 per cent as a guideline in the US.

Once you have all of those numbers tallied, you have the expenses part of your formula. We're going to use $20,000 as our example number.

Profit

To make a consistent profit, build it into the operating costs of your shop rather than trying to make a profit on each individual project. This can protect you from the projects that do go over budget or that you underestimate.

To calculate profit, add a percentage to your monthly expense total. Find a guideline that makes sense for you and your business, at Nine Labs we have a base profit of 20 per cent. Because profit is built into the shop rate, every unit of time you sell is already profitable. Here's the formula, using $20,000 as the example expense figure:

20,000 + 20% = 24,000

That means above all of our expenses, salaries, annual costs and taxes, we're going to make an additional $4,000 each month.

But profit opportunities don't stop there. We still target an additional profit of between 20 per cent and 40 per cent on each individual project by quoting the right price. We can do this using a variety of methods.

Hours

Hours are the billable time you have available to work. This means the time each person can spend on services; not how many hours they're at work. If you have employees, this is the sum of everyone's billable time added together to give your shop's total bucket of hours.

The average is 30 billable hours per week for production employees, and 20 or less for owners and management. Non-billable employees, such as project managers or sales, do not contribute – their salaries were included as part of your expenses calculation.

When working out this figure, the goal is to find a real number that is sustainable for your business, not to see how many hours you could work if you gave up your nights and weekends.

Billing rate

You've now added up your expenses, built in profit, and know how many hours you have to sell. So if we have $20,000 in expenses, $4,000 in profit, and 160 billable hours to sell, we have a shop rate of $150 per hour.

(20,000 + 4,000) ÷ 160 = 150

The difference between your shop rate and your billing rate is how it's used. Your shop rate is private and can't be moved; it's never negotiable.

Your billing rate (if you choose to bill hourly) is public and can be negotiated, but it should never be less than your shop rate. It's up to you to determine what it is, based on your market, your interest in the work, and your current cash flow.

Get a crash course in pricing your work with Brad Weaver at Generate London. In addition to his talk, Brad will also be hosting an all-day on workshop on how to start and build a profitable design business. Book now!

This article was originally published in net magazine issue 281. Buy it here.

Thank you for reading 5 articles this month* Join now for unlimited access

Enjoy your first month for just £1 / $1 / €1

*Read 5 free articles per month without a subscription

Join now for unlimited access

Try first month for just £1 / $1 / €1