10 tips for being a better freelancer

Developer Anna Debenham, who has been self-employed since her teens, reveals her 10 insider tips to help you be your own boss.

Your first year of being freelance is the toughest. You have to get to grips with all the paperwork, legislation, and cashflow, plus the stress of being out on your own. And as if that wasn't enough, freelancing can be risky.

You'll find that borrowing money or even renting a house isn't as straightforward as it would be if you were employed. Many lenders expect to see a minimum of three years of accounts prepared by a chartered accountant. And if you're a sole trader and go into debt, you could lose your house.

Yet you'll still do it, and love it (well, most of the time). If you're in this for the long haul and want to take your business more seriously, here are ten tips that have helped me in my own career. Some of the details are specific to the UK, but the principles should hold true anywhere in the world.

01. Get an accountant

If you don't already have one, get an accountant. A good accountant will earn you back what you pay them, plus some. They'll help you get set up, give you the advice you need to keep you on good terms with HMRC, check through your books and file your accounts.

Get personal recommendations if you can, and look specifically for someone who specialises in your line of work and deals mainly with freelancers or small companies. Check that they're familiar (or at least comfortable) with using whatever accounting system you use. Once you have an accountant, schedule a call with them every six months to ask questions and get advice on how you can improve cashflow.

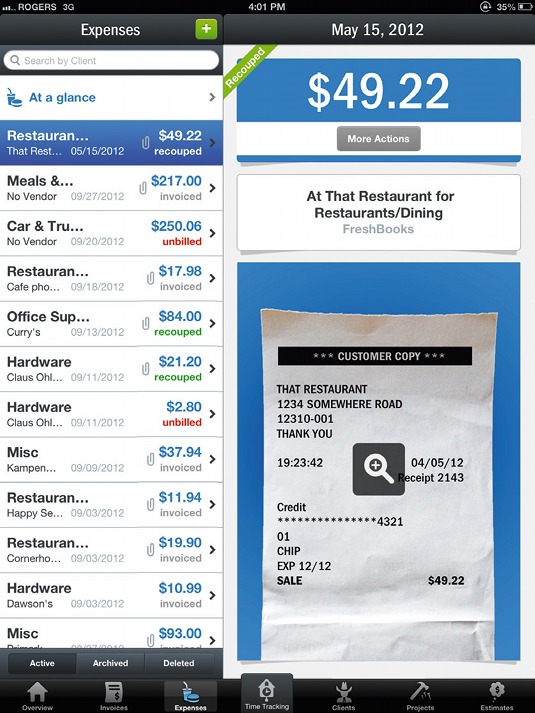

Keep up to date with your bookkeeping so there's no frantic rush before a tax deadline. I spend at least an hour each Friday keeping my accounts up to date: scanning receipts, writing up invoices and chasing up unpaid bills. If you get a lot of receipts, a service such as Receipt Bank that scans receipts you've posted to them might be useful.

Doing your accounts in a spreadsheet and invoices in text documents might make sense when you're starting out, but it's a headache to maintain and creates a lot of margin for error. (I've been there.) Fortunately, there's a plethora of great online accounting software that will ease the burden of paperwork, such as Xero, FreeAgent, FreshBooks and Harvest.

Get the Creative Bloq Newsletter

Daily design news, reviews, how-tos and more, as picked by the editors.

And if you are really reluctant to hire an accountant, a lot of freelancers recommend Crunch, an online accounting package that also includes unlimited advice from real accountants.

02. Pick a company structure

There are other types of legal structure for a business, but most freelancers will need to decide between becoming a sole trader (or in the US, a sole proprietor) or forming a limited company.

Setting up as a sole trader involves registering as self-employed with HMRC. As a sole trader, you are the business. You don't need a separate business bank account (although many people have one anyway). This keeps things simple, but if your business loses money, you could lose your personal assets, including your home. Being a limited company, you'd only lose your company assets.

I registered as a sole trader when I first went freelance in my late teens. I was fresh out of school, not earning a lot, and I didn't want to handle a lot of paperwork on top of trying to learn my trade. This worked perfectly until I started earning more and working for bigger firms. I found that some companies I wanted to work with wouldn't won't deal directly with sole traders, so I had to choose between turning the project down, going through an umbrella company, or – my eventual solution – going limited.

As a limited company, you're a separate entity to the business. You hold shares in it and pay yourself a salary – or even award yourself dividends. Setting up as a company can feel a bit weird if you're just one person, since you have to appoint a director (you) and secretary (again, you), and have a meeting with yourself before you can do things like paying out dividends, but it can be the best long-term solution.

If you love working for yourself but hate all the paperwork, using an umbrella company can be another good option. It's basically the same as working for an employer, but the umbrella company doesn't set what work you do; it just deals with the financial admin.

Parasol, one of the biggest umbrella companies in the UK, calculates how much tax you need to pay, chases up bills if the client is late in paying, and as you're effectively its employee, also provides statutory sick pay and holiday pay. It takes a cut of what you charge, though, so make sure you check out what the fees will be.

03. Understand VAT

Although you don't have to register for VAT until your turnover is more than £79,000 (at least, that was the case when this article went to press; you can check the current figure at gov.uk/ vat-registration), you may benefit from voluntarily registering for VAT.

The flat-rate VAT scheme is designed for companies with sales of under £150,000. You pay HMRC a fixed rate of VAT (14.5 per cent for IT consultancy), minus one per cent for your first year of being registered. You're then able to pocket the difference between the quantity of VAT you've charged your client, and the amount you pay to HMRC.

The downside is that you don't get to reclaim VAT on your purchases, apart from capital assets worth over £2,000 such as a fancy new laptop. But being in this line of work, you probably don't have to make that many purchases. It's a scheme that's well worth discussing with your accountant.

04. Price your work correctly

The factor that most affects how much you earn is how much you charge. Remember that you can't charge for all of your time – some of it will inevitably be spent doing unbillable tasks such as admin, accounting and learning new skills.

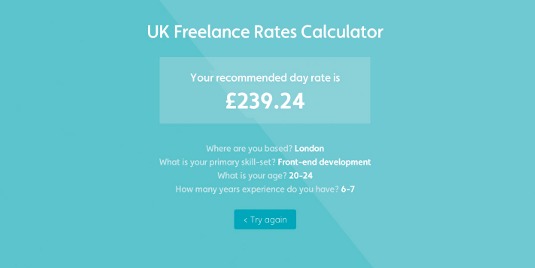

In order to help you price your work appropriately, UK agency Mud has created a handy Freelance Rates Calculator based on the rates that people currently charge in various regions of the UK.

Also take into account how different types of project are going to affect your bottom line – working on a project remotely is probably going to be cheaper than a project where you have to travel and eat out every day. Increase your rate slightly with each new project as you gain experience.

05. Sort out your invoices

Ideally, you want your invoice terms to be as short as possible so you get paid more quickly: typically 14 days, seven days, or on receipt. But realistically, not all clients are prepared to change their payment terms just for you, and you may end up having to wait 30 days or more to get paid. To get round long invoice terms at the client's end, ask if you can bill weekly. Invoicing little and often improves cashflow, and having good cashflow prevents stressful cycles of feast and famine.

This may sound like stating the obvious, but it's also really important to send invoices promptly. In a recent analysis of FreeAgent's data, invoices that were sent within a week of the work being finished got paid, on average, in fewer than five days. When the invoice was sent just a week later, the average time to payment doubled to 10 days.

If your invoice is more than 30 days overdue, the government says that you can start charging interest at eight per cent over the Bank of England base rate.

06. Pay yourself!

Even if you don't need one as a sole trader, setting up a separate business account helps make sorting through your finances easier. You should be putting aside a proportion of what you're earning into a savings account ready for the taxman.

If you're a limited company, to pay yourself a salary, you'll need to register with HMRC as a new employer and use their Real Time Information (RTI) system for PAYE. Every month, you'll need to do payroll, which consists of submitting a form for each employee that details how much they're getting paid and what their National Insurance (NI) contributions are. You need to do this even if it's just you, because you are effectively an employee of your own company.

Some accounting software packages have this functionality built in, so after putting in some initial details, running payroll each month is a fairly straightforward procedure.

When you pay yourself dividends, you'll need to hold a director's meeting in which you 'declare' the dividend (yep, even if it's just you) and you'll also need to keep notes of the meeting (also known as a 'dividend declaration'). These records will be requested by HMRC if it performs an investigation on your business. Declaration isn't as daunting as it sounds. FreeAgent automatically prepares declarations every time you explain a transaction as being a dividend, or you can ask your accountant to do this for you.

07. Find the right workplace

There seems to be an increasing expectation that freelancers will work onsite as clients realise the value of having designers and developers working side by side. If you live outside of a big city, you'll need to be prepared to travel and, if you're going to be commuting for a project regularly, decide whether you're willing to swallow the expenses associated with travel, add them onto your day rate, or charge for them separately. It's always best to be upfront with your clients about this so they don't get any nasty surprises down the line.

If you're working from home most of the time, you can claim a proportion of expenses such as council tax, electricity, heating, phone calls and broadband as tax allowances. How much you qualify for varies depending on factors such as whether you have a dedicated workspace, such as a separate study, so this is something you should discuss with your accountant.

If you're used to working around other people and miss the daily interaction, you might benefit from renting a desk in a co-working studio full of other freelancers. They're popping up all over the place, and most offer meeting rooms: handy, since having to invite a client round to your home for a meeting can be awkward.

08. Always use contracts

I can't stress enough how important it is to use a contract. It's not just there to protect you, but also represents a good opportunity to explain how you work and what the client can expect of you.

Drawing up a contract doesn't have to be taxing or scary process. Take a look at Andrew Clarke's Contract Killer: it's really approachable and is something I've used with my own clients.

Also bear in mind that if you're working for a company as a contractor in a way that could be classed as 'disguised employment' , you may not be IR35-compliant, in which case you run the risk of being fined by HMRC. These are some of the points that HMRC uses to assess whether you are compliant:

- Whether the projects you work on are discrete pieces of work

- Whether, if you are doing multiple projects for the same client, each has its own contract with a start and end date

- Whether you can hire someone on your own terms to do the work on your behalf

- Whether you use your own equipment

- Whether you work with multiple clients.

It's a good idea to check whether these points are true for the work you're doing, and clarify them in your contract in case you get investigated.

09. Raise your profile

Your most valuable source of work is word of mouth. Keep in touch with fellow freelancers, in particular those you enjoy working with and whose skills complement yours. I've found I get most of my development work through designers and local agencies after their client has asked for a recommendation.

But word-of-mouth recommendation alone isn't always enough. Potential clients still expect to be able to see examples of your work. I struggle to recommend people to clients (even if I know they're good) if their portfolio is a holding page, or their GitHub profile is empty.

Of course, signing up with a recruitment agency is always an option if you really want to offload the task of finding new contracts. It's almost like having your own agent.

10. Remember your goals

Something you should regularly ask yourself is, "Why do I freelance?" Maybe it's because you want more time, more money, more freedom to work with the clients you want, or the opportunity to learn new things. But whatever your motivation, choose your jobs accordingly.

If the money is less of a priority to you than time, choose projects that offer you more flexibility. If you want to increase the amount you earn, get used to being more ruthless with your finances and compete for projects that pay a higher rate.

Either way, keep your goals in mind when making decisions to help you become a happier, more successful freelancer.

Words: Anna Debenham Illustration: Mike Chipperfield

Anna Debenham is a frontend developer based in Brighton. She began freelancing when she was 18 – and won net's Young Developer of the Year award in 2013. This article originally appeared in net magazine issue 254.

Thank you for reading 5 articles this month* Join now for unlimited access

Enjoy your first month for just £1 / $1 / €1

*Read 5 free articles per month without a subscription

Join now for unlimited access

Try first month for just £1 / $1 / €1

The Creative Bloq team is made up of a group of design fans, and has changed and evolved since Creative Bloq began back in 2012. The current website team consists of eight full-time members of staff: Editor Georgia Coggan, Deputy Editor Rosie Hilder, Ecommerce Editor Beren Neale, Senior News Editor Daniel Piper, Editor, Digital Art and 3D Ian Dean, Tech Reviews Editor Erlingur Einarsson, Ecommerce Writer Beth Nicholls and Staff Writer Natalie Fear, as well as a roster of freelancers from around the world. The ImagineFX magazine team also pitch in, ensuring that content from leading digital art publication ImagineFX is represented on Creative Bloq.